Ratings agency Moody's is adamant that Nigeria's efforts to push through urgent tax reforms will face "social and institutional constraints" even after a new president is elected. Fiscal pressures are likely to even worsen after the election, experts write in a recent report. It must be said that the country knows no respite economically. The Central Bank of Nigeria (CBN) also announced this Thursday, February 2, the distribution of new banknotes at bank counters to reduce massive queues at ATMs, a decision aimed at allaying growing social unrest.

Moody's rating service lowered the country's long-term external debt rating from B3 to Caa1 in late January with a stable outlook.

The downgrade of Africa's largest economy is due to the fiscal situation as debt continues to deteriorate. “Depressed and uncertain oil production, capital outflows amid a flight to quality and limited government access to external financing are likely to continue to weigh on Nigeria's external position in 2023,” Moody's said.

With three weeks to go before presidential and legislative elections in Africa's most populous country, Nigerians are frustrated not only with ongoing reforms, but also with struggling to get hold of cash. after the introduction of new banknotes at the end of 2022. They are indeed already faced with fuel shortages and frequent load shedding. "The (Central Bank) Governor, Mr. Godwin Emefiele, has ordered the depository banks to pay for the new Naira notes at the counters within the daily limit of 20,000 Naira ($40)," the spokesperson said. Osita Nwanisobi.

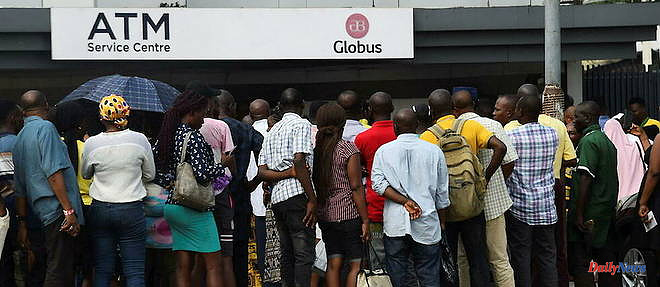

Everywhere in Nigeria, especially in the megalopolis Lagos and in the capital Abuja, many people wait for hours in front of the very few distributors issuing the new tickets.

Enough to fuel the exasperation of Nigerians, the majority of whom live in poverty and depend on the informal economy, where cash remains essential. Riots broke out this week in Kano, the largest city in the north of the country.

In October, the Central Bank announced, without warning, to change the banknotes (including their color), and decided that the old notes would no longer be valid on January 31, 25 days before the presidential election.

This calendar is highly criticized in Nigeria, where pre-election periods are already synonymous with suffering for Nigerians. Economic activity there is slowing down, fuel shortages are greater than usual, and insecurity is growing.

Faced with popular pressure, the authorities postponed the date to February 10, specifying that there would be a seven-day grace period after the deadline for depositing the old notes at the central bank. The CBN blames the shortage in particular on a significant number of people "hoarding" and "hoarding" the new tickets they obtain by withdrawing "in series" from vending machines.

The new notes, according to the CBN, are aimed at reducing the volume of money outside the banking system to optimize monetary policies, combat counterfeit currency and complicate ransom payments to kidnappers in the kidnapping-ridden country.

And for Moody's, the election of a new president could not change the situation, even if the latter accelerates economic reforms, the "implementation of which will probably remain long amid marked social and institutional constraints", said Moody's. “Fiscal pressure from declining oil production, increasingly expensive oil subsidies as well as rising interest rates are likely to persist for the next two years. »

The election in Nigeria, where some 93 million Nigerians are registered to vote, has sparked unprecedented interest, especially among young people, who hope for a sea change for the 215 million-scarred West African nation. by corruption, glaring inequalities, near-generalized insecurity and an exodus of the country's elite.