The actions of the Central banks have worked on the first strikes of the Corona-crisis-stabilizing. But they are dependent on the support of the States, when it comes, growth to the region. In their annual report published Tuesday, the Bank for International settlements (BIS), which is considered the Bank of Central banks, warns, moreover, against a to the financial markets, Overconfidence is not growing because the scale of the crisis is still far from known.

Markus Frühauf

editor in the economy.

F. A. Z. Twitterthe BIZ is now estimated to be rising corporate insolvencies. After the standstill of the economy initially led to liquidity problems, will now put the survival ability of many companies to the test. "Monetary policy alone cannot be the engine of growth," said BIS General Director Agustín Carstens at the annual General meeting in Basel.

With a view on the rising public debt in the Wake of the crisis measures taken by the former Central Bank Governor of Mexico considers it essential that fiscal policy remains a timely consolidation on a sustainable path. This could assist the economic growth and financial stability. Carstens also holds the structural reforms necessary.

a Chance for a new politics

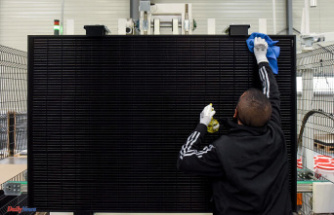

So high, the damage of the Corona-crisis, it offers simultaneously the opportunity for a growth-enhancing policy. Since the resources for which governments are limited, you should prefer investing in a environmentally sustainable growth, such as in the in the Wake of the climate risks necessary reorientation of the energy sector, called for Carstens.

The Basel-based BIS are more than 60 Central banks for which it manages foreign exchange reserves, as well as a monetary policy think tank serves. The profit of the BIZ in the fiscal year 2019/2020 (31. March) has been pressed at the end of the market dislocations caused by the Corona-crisis-to-bottom. The net profit decreased compared to the previous year, from 461 million to 166 million special drawing rights. The International monetary Fund (IMF) introduced paper money is based on a currency basket comprising the Dollar, Euro, Swiss franc, pound sterling and Renminbi and the equivalent of 135,5 million Euro.

The BIZ advises Central banks, to gain timely monetary policy space. Chief economist Claudio Borio considers this as the most important challenge. A Combination of monetary, fiscal policy and regulation is necessary if growth is to be sustainable and in line with the financial stability.

Date Of Update: 30 June 2020, 13:20