Like the entire industry, the chemical giant BASF is massively affected by the high energy costs. The DAX group is now pulling the ripcord and wants to save half a billion euros a year. Job cuts should also contribute to this.

The chemical giant BASF pulls out the red pencil after a slump in earnings in the third quarter and red figures in Germany. Outside of production, 500 million euros are to be saved annually, as the group announced. Job cuts are also planned, but BASF did not provide any information about the possible extent. "We are in the early stages of planning," said a spokesman. Corporate, service and research areas as well as the Corporate Center, the central corporate control unit, are to be streamlined. The focus of the program, which is to be implemented over the next two years, is on Europe and Germany in particular.

At the company headquarters in Ludwigshafen, the company employs around 39,000 of its 110,700 employees. According to the current site agreement, operational layoffs are excluded until the end of 2025. BASF announced talks with employee representatives. We will monitor the process critically," said works council chief Sinischa Horvat. "If jobs are lost, the corresponding work must also be lost. This must not be spread over more shoulders." In the previous austerity program, which ran until the end of 2021, BASF had cut more than 6,000 jobs worldwide.

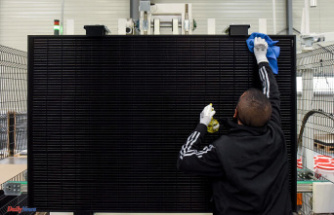

BASF is suffering from the increased energy and raw material costs, which are putting increasing pressure on the group, which is the largest industrial gas consumer in Germany. Overall, the chemical-pharmaceutical industry is the largest gas consumer in Germany with a 15 percent share of total consumption. She is currently in the middle of collective bargaining, which is due to continue in the third round on October 16.

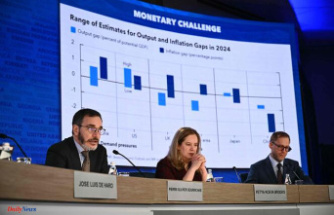

In the third quarter, adjusted operating earnings (EBIT) fell by almost 28 percent to just under 1.35 billion euros, according to preliminary figures. This means that BASF performed slightly better than analysts had expected. Net income was significantly impacted by EUR 740 million in non-cash impairments on Nord Stream. Through its stake in Wintershall Dea, BASF indirectly holds a stake in Nord Stream AG, which operates the Nord Stream 1 gas pipeline. Ultimately, the bottom line was 909 million euros after 1.25 billion euros a year ago.

In the second quarter, however, the operating result of 2.34 billion euros was only slightly below the previous year's level. In addition, there was now a loss in Germany, as BASF admitted. The company was only able to partially pass on the increased costs to customers through higher sales prices.

Revenue rose by 12 percent in the summer to around 21.95 billion euros, with tailwind also coming from the strong dollar. BASF confirmed the forecast for this year, which CEO Martin Brudermüller raised at the end of July. Accordingly, the group continues to expect sales of 86 billion to 89 billion euros and an adjusted operating result of 6.8 billion to 7.2 billion euros.

Investors reacted with relief to the numbers. Above all, the confirmation of the forecast was well received and the paper increased. BASF intends to publish the final figures on October 26.