Company Overview

CAPEX.com is a website operated by Key Way Investments Limited, an entity authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC). The brand is specialized in CFD trading services related to a wide range of assets that include FX, stocks, bonds, indices, commodities, ETFs, cryptocurrencies, and many others. With a long track record of providing high-quality services, CAPEX is one of the companies that continue to innovate. It keeps improving the features available for clients as well as adding new instruments to meet the demands of the current market uncertainty.

Regulation

The CFD provider is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 292/16. Additionally, it is one of the few brokers that have registered with all the European regulators. CAPEX is registered with 29 different regulators in Europe, including names like UK’s Financial Conduct Authority (FCA), Germany’s BaFin, France’s AMF, or Norway’s NFSA. Due to its commitment to comply with regulation, CAPEX had managed to build a solid reputation and continues to bring innovations into the world of CFD trading.

Account Types

Traders wanting to work with CAPEX can choose between three different account types: Essential, Original, and Signature. The minimum deposit required to open a trading account is $100, according to the official website, and depending on the account chosen, clients will get access to a different set of features. Daily market reviews & financial research, daily analyst recommendations (provided by a third party), access to a video library, special trading conditions, or several integrated tools like Trading Central, Bloggers Opinions, and Insiders’ Hot Stocks are some of them.

Alt-text: Capex account types

Capex Assets

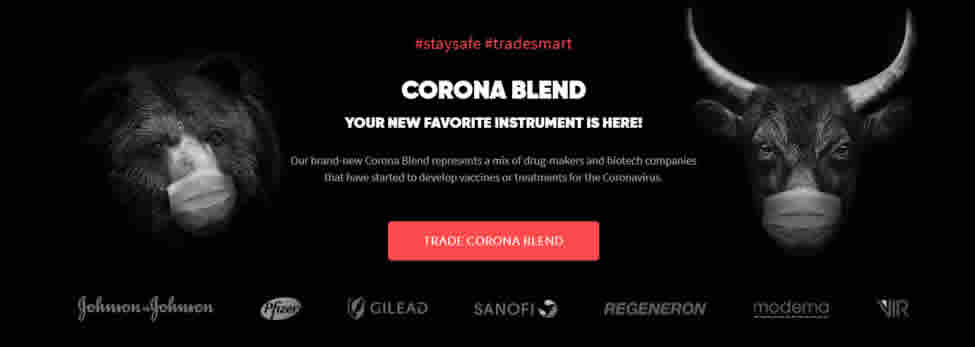

At CAPEX.com traders have access to 2,100+ CFDs based on forex, indices, bonds, ETFs, commodities, shares, blends, and cryptocurrencies. The offer covers enough markets to provide sufficient alternatives for building a diversified portfolio. At the same time, the company is constantly adding new instruments like the recent Corona Blend.

The CAPEX Corona Blend represents a mix of drug-makers and biotech companies that have started to develop vaccines or treatments for the Coronavirus. Johnson&Johnson, Pfizer, Gilead, Sanofi, Regeneron, Moderna, and VIR are companies that are part of the instrument. Considering the unique trading conditions traders have to face in 2020, including such names into one’s portfolio should be an efficient way to gain exposure on stocks that should remain popular throughout the entire year.

Alt-text: Capex Corona Blend

Unfortunately, the coronavirus had influenced meaningfully how the global economy operates. Now with CAPEX Corona blend, CFD traders have a unique opportunity to be versatile and trade CFDs of pharmaceutical and biotech companies that are relevant to such a dramatic period. With the help of Capex, navigating the worse pandemic in a century should become a search for opportunities and not a fight for survival.

It is during these times traders need their brokers to step up and deliver the best trading conditions. CAPEX.com had proven over the years that it is a reliable and well-regulated CFD provider, able to deliver and constantly improve the best trading features.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.93% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Date Of Update: 11 June 2020, 08:25