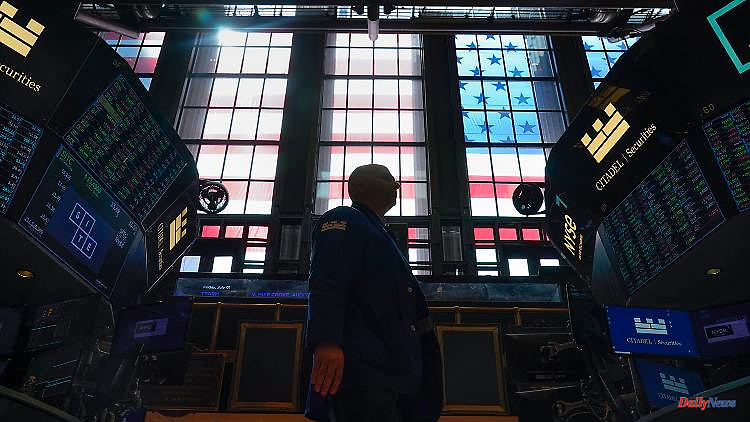

The recent recovery rally on Wall Street continues - albeit subdued. Europe's gas supply and the associated concerns about international consequences continue to play the central role on the stock markets. Good news, on the other hand, comes from the Netflix streaming service.

In the middle of the week, the technology-heavy Nasdaq on Wall Street rose significantly, while the other indices lagged behind. Netflix's business card provided positive sentiment in the technology sector. Overall, traders referred to the sentiment on the US stock exchanges, which was at historic lows. However, this circumstance opens up opportunities for a turning point in the market crisis, according to the trade. The trigger could be the company's reporting period.

"Market sentiment is worse today than when the pandemic began; even 2008 pales in comparison to the current bear market. This reporting period could be the catalyst for that to slowly change," said Globalt portfolio manager Keith Buchanan. Elsewhere, hopes were raised that Russian gas supplies via the Nord Stream 1 pipeline could resume on Thursday, significantly reducing the risk of a recession, at least in Europe. The Dow Jones index rose 0.2 percent to 31,875 points, p

Even weak real estate data did not dampen sentiment: Existing home sales in the US fell for the fifth straight month and also missed expectations. Rising market interest rates and rising prices reduced the desire to buy. However, the companies' quarterly reports delivered a few positive surprises: Netflix ( 7.4%) was the most important. The streaming provider lost subscribers in the second quarter, but not nearly as many as feared. Pharmaceutical company Abbott Laboratories also fared better than expected and also upgraded its outlook. However, the share fell by 1.5 percent because the food division had recorded a drop in sales. A recall campaign for baby food and a temporary stop in the production of the corresponding products had a negative impact.

The outlook for the health insurer Elevance Health (-7.6%) contained light and shadow. Although the company had raised its full-year guidance for adjusted earnings, it became more pessimistic about unadjusted earnings. Stock exchange operator Nasdaq (6.1%) earned more than expected. The company also announced a 1:3 stock split. The retailer Bath

The oil service provider Baker Hughes (-8.3%) came up with a quarterly loss and also spoke of a further weakening of demand. For the Merck course

Safe havens" hardly in demand - Draghi pushes the euro

The "safe havens" show that the mood seemed to be improving. The bond market turned negative, and yields turned positive as a result. However, the dollar rose, with the dollar index rising by 0.4 percent. However, this was primarily due to the weakness of the euro. Because it came under pressure in the early evening and fell well below the $1.02 mark.

In trade, reference was made to the impending government crisis in Italy. Prime Minister Mario Draghi's efforts to resolve the recent government crisis had failed. Three governing parties refused to take part in a confidence vote requested by Draghi. New elections with an uncertain outcome are now threatening in Italy. Oil prices fell despite US crude stockpiles shrinking over the previous week. However, contrary to expectations, petrol stocks increased significantly.

In trade, there was talk of weak demand for fuel in the USA. The market is currently caught between fears of a possible decline in demand due to the economy and a shortage of supply. Gold fell - weighed down by the strength of the dollar and higher market interest rates.