Europe's gas problems suddenly seem much smaller than they were a few months ago. The gas storage tanks are "packed to the brim". There is more LPG than the market currently needs. Spot prices are coming back. Why? Was the crisis just imagined?

The temperatures are mild, the gas storage tanks are full, the supply of liquefied natural gas (LNG) is running smoothly, new terminals are being built out of the ground, and the price of gas has come down significantly from its astronomical heights. It's not all good again, not even as if nothing had happened. But there is good news at the end of the year. The energy crisis is shrinking and things are easing.

Hardly anything demonstrates the relaxation on the energy market better than the LNG tankers lying off Europe's coasts. According to the analysis company Vortexa, a few days ago 34 LNG freighters anchored in the open sea without heading for a port. The background is the falling gas prices. European benchmark gas futures for November are down about two-thirds in the past few weeks. The December contracts are already slightly higher again. Commodity traders are trying to maximize returns on the $2 billion offshore cargo. worth waiting.

When traders gamble, preferring to use their freighters as floating warehouses to wait for higher spot prices, it means the market is full. Europe is being inundated with LPG and can afford - at least for the moment - to wait. The mild temperatures have bought the states valuable time.

Mainly to fill their camps. Since this week, the German gas storage facilities have been bursting at the seams with filling levels of over 100 percent that have never been reached in history. "Proppevoll", commented network agency head Klaus Müller with satisfaction. "The gas system in Europe is full," quotes the New York Times (NYT) as saying the CEO of the Spanish gas operator Enagas, Arturo Gonzalo Aizpiri. And the "Financial Times" (FT) writes: "Welcome to the mild West".

Such a development was hardly conceivable in the spring. But as things stand today, the gas flames will not go out that quickly, there will be no rapid blackout and nobody will have to do without a warm shower or heating because of a lack of gas. A replacement for Russian gas has been found, and the prices also give cause for hope.

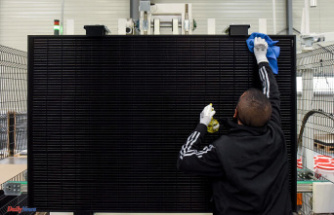

Germany is also pushing the tube when it comes to building LNG terminals. The so-called Floating Terminal in Wilhelmshaven was completed this week - within just 200 days. Federal Minister of Economics Robert Habeck praised the construction of Germany's first liquid gas terminal as a central component of energy security.

A miracle has happened. And it was not only the mild temperatures that contributed to this - consumption in Europe is currently around 30 percent below the seasonal average - but above all the liquid gas deliveries from the USA. Then, when the situation that Americans have repeatedly warned about in the past arose, American LNG helped replace dwindling Russian gas.

It was also helpful that the EU countries showed solidarity during the crisis. Surpluses are redistributed to European partners. According to the independent investment company Frankfurt Asset Management, Spain has a storage capacity of 36 billion cubic meters per year, but only needs half of that. So there is enough left over to support Germany, for example, if needed. The only thing missing is the infrastructure that makes a simple exchange possible. But that too is about to change soon.

Paradoxically, another sign of easing on the energy market is the fact that gas producers are keen to flare off gas. Flaring will increase again in America's largest shale oil basin, according to Bloomberg, forecast by Norwegian oil and gas industry analyst Rystad Energy.

Gas production in the Permian Basin has recovered faster than pipeline capacity has grown since the pandemic. Therefore, at this price level, it makes more economic sense for producers to burn gas and pump the more expensive oil. Completing several major pipeline extensions will take into the second half of next year. The prospects for next winter are good because it could help cushion future supply bottlenecks. If push comes to shove and prices rise again accordingly, there's more gas to be had here.

Ciaran Roe, global director for LNG at financial services company S

As of today, Germany has to close a gas gap of 20 percent. The savings achieved so far show that this is feasible, but may soon no longer be necessary: "Things are much better now than they looked in May," quotes the "FT" Rui Soares from Frankfurt Asset Management. "If the terminals are operational, even this casualty could be avoidable," Soares said. "It will be a less pleasant winter than usual in Germany, but households will not freeze and industry will not collapse. Reality is better than perception."