While the auto industry is still complaining about delivery bottlenecks, chip demand is falling drastically in other areas. An abrupt end is forecast for the semiconductor boom. Ironically, after many countries launched investment programs worth billions.

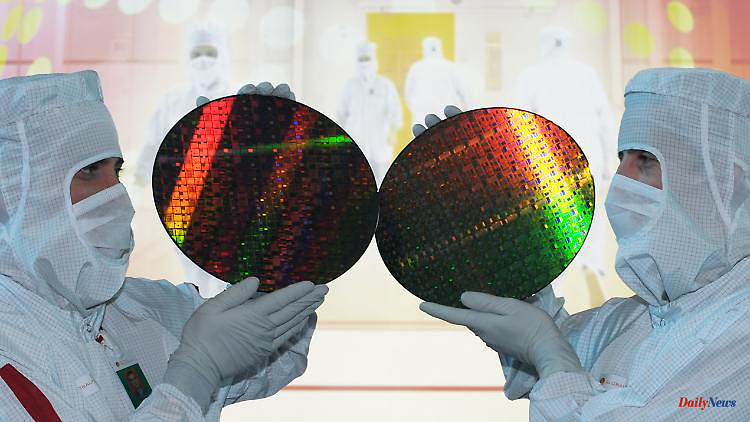

It feels like the world never gets enough of semiconductors. Chips for electronic controls are needed everywhere: in cars, household appliances, smartphones and consumer electronics. Since the outbreak of the pandemic, complaints about bottlenecks and shortages have been making the headlines. Unfinished cars had to be parked in parking lots, and eagerly awaited game consoles were missing under the Christmas tree. After the panic about the lack of chips, a correction that is just as quick is surprisingly announced.

The chronic shortage of chips seems to have passed its peak - at least in certain areas. There are increasing indications of a correction: Nvidia, one of the largest developers of graphics processors and chipsets for PCs, data center servers and game consoles, reported disastrous numbers a week ago. Sales in the core business collapsed by more than 40 percent. Intel fared no better. Computer chip suppliers estimate that their revenues will collapse by up to 50 percent in 2022.

The industry is not only struggling with the ending corona pandemic and the shrinking demand for computers because employees are returning to the office, as the trade journal “PC Games Hardware” writes. The recent crypto crash is also leaving deep marks on the balance sheets. According to industry information, sales of graphics cards, among other things for digging for digital currencies, should shrink by half. Intel and Nvidia have adjusted their shipping and revenue forecasts for 2022 accordingly.

Micron, the largest manufacturer of memory chips in the USA, has already warned of a slump in demand. The bad news was announced on the very day that US President Joe Biden signed the "Chips and Science Act" with state aid of 52 billion US dollars to boost domestic production. "It's kind of black humor," Sanford C. Bernstein analyst Stacy Rasgon commented on the timing to US finance agency Bloomberg. "Politicians will find out how quickly bottlenecks can be solved when the industry turns."

Not only the US, but also Europe, China and Japan may experience it. Because they have all decided on large investment programs to boost chip production due to the supply chain problems in the Corona crisis and geopolitical tensions. At least in the short term, there is a risk "of investing in production capacity that is heading for an economic downturn," Fitch expert Jason Pompeii quotes Bloomberg as saying.

The latest industry data from China, according to which the production of integrated circuits fell by 17 percent after the corona-related special boom in July, also confirms that a hangover is the order of the day.

At the end of last week, the "Financial Times" reported on abrupt cancellations at the largest Chinese semiconductor manufacturer, Semiconductor Manufacturing International Corporation (SMIC). According to CEO Haijun Zhao, demand for chips used in smartphones and consumer electronics has fallen the most. The sales of Chinese smartphone manufacturers shrank by half in the first half of the year, it said. On the other hand, the demand for chips for industrial controls or automotive applications is stable. He cited not only inflation and a cyclical decline in demand as reasons, but also indirectly the worsening of the Taiwan conflict.

Expert forecasts are bleak. Citigroup analyst Christopher Danely expects the setback for the industry to be the worst in at least 10 years, possibly 20 years. Every company and every chip category will probably suffer.

The biggest buyers of chips are PC manufacturers. According to Bloomberg, the fact that overall shipments of desktop processors have fallen more sharply year-on-year than in almost 40 years is a harbinger of "dark times". A boom-and-bust cycle—first big hype, followed by bursting—is nothing new for the semiconductor industry. The industry has experienced such roller coaster rides several times in its history.