Tesla boss Elon Musk makes it exciting again before this year's Investor Day. The eccentric company boss announces no less than a "master plan part three". The focus is on Musk's overdue promise to bring a cheaper model to the market.

Tesla invites you to its annual investor day again today. There will be a lot of discussion on topics like Tesla's growing electric power business and increasing cash flow. That much is certain. But what Wall Street really wants to see is planning for a new car. Quite a few analysts think a new, lower-priced Tesla model is overdue to ensure the EV pioneer's growth through the end of the decade. Otherwise, the group could hardly defend its market share against the many e-car models from traditional car manufacturers. "This year's beauty contest should be a very special one for Elon Musk, because the pioneer of electromobility has to reinvent itself in a certain way," writes Konstantin Oldenburger from CMC Market.

Tesla shares could also use a tailwind. The paper is up 64 percent so far this year and, from a technical point of view, has been recovering from the price drop last year since breaking out above 125 US dollars. It remains to be seen whether this will result in a new upward trend. At this point in time, it is not yet possible to say, according to Oldenburger. There is still some upward resistance to overcome. However, the analysts agree that the share absolutely needs a new impetus after such a rally. According to Wells Fargo analyst Colin Langan, a $30,000 third-generation vehicle could be such an impetus.

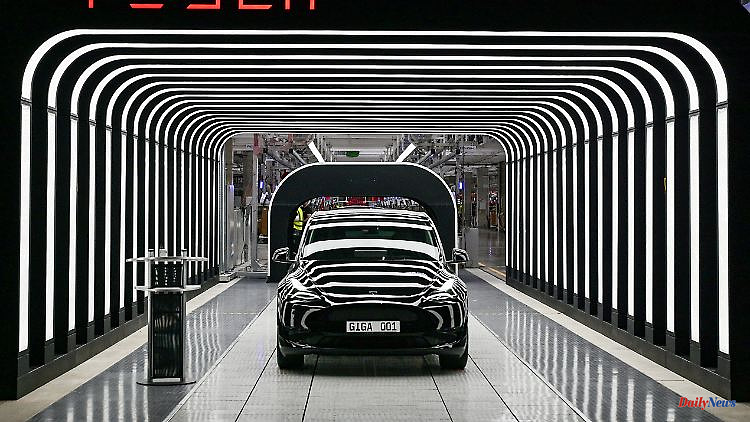

Traditionally, the teaser image on the Investor Day invitation provides clues as to what to expect at the annual Tesla event. The structured background catches the eye this time. "True to tradition," he always points out "possible updates and strategies," according to Oldenburger. In his opinion, it should be about vehicle bodies. Sandy Munro, an auto industry veteran who has long worked for Ford, spells this out. If you zoom in, they are side panels of an unidentifiable Tesla model coming out of Tesla's stamping plant, along with their intended mounting brackets. The parts could fit the Model Y. Whether this really provides an indication that new vehicles will be presented will be seen later in the evening.

But the fact is that all of Tesla's current models, with the exception of the Model Y, are now more than four years old and belong to the upper price range vehicles. Prices today for a Model S start at around $95,000 and for a Model X at around $110,000. A Model 3 starts at around $43,000 and a Model Y at around $55,000. "The prices for a Tesla are so high, also because the batteries continue to represent a large block of costs," says the CMC analyst Oldenburger. Rumors about a cheap small car from Tesla have therefore been around for a long time. Tesla boss Elon Musk himself announced in 2020 that he also wanted to launch a more affordable vehicle. For 2023 he promised a car that should go on sale at a price of 25,000 US dollars. In the course of the global shortage of components triggered by the corona pandemic, however, he revised the statement again.

The rumors have persisted ever since. A price of $30,000 for a new Model 3 would "dramatically expand the market that Tesla can address," Wells Fargo's Colin Langan is convinced. Tesla's current product range covers only about 55 percent of the entire automotive market. A $30,000 vehicle would serve about 95 percent of Tesla's lineup. Bernstein analyst Toni Sacconaghi also agrees: "The most important topic for Tesla on the way to Analyst Day is the status of its lower-cost next-generation vehicle platform," he writes in a recent study. "Our research has shown that EV models generally struggle to increase volume beyond the third or fourth year of introduction." Tesla needs the cheaper e-car to meet the high growth expectations of investors.

The Model 3 made its debut in 2017 and the Model Y was released in 2020. Wall Street expects Tesla to sell more than a million Model Ys by 2023. That would probably make it the best-selling car in the world, including petrol-powered cars. However, further growth could then become difficult. Increasing sales of a single model to two million a year is a very ambitious goal. Currently, Toyota's Corolla is the best-selling model in the world with around 1.1 million vehicles sold in 2022. The Model Y was the fourth best-selling vehicle with around 760,000 units delivered.

New Street Research's Pierre Ferragu reckons a budget car could be ready by 2025. Given Tesla's lead in battery costs and manufacturing electric cars, he thinks the car could actually sell for around $25,000. According to his estimates, a low-cost Tesla could sell more than a million units by 2026. And he also reckons that the Model 3 and Model Y could both easily sell more than a million units a year. He does not share Sacconaghi's concerns.

Musk's growth plans are very ambitious. Musk wants to sell 20 million cars a year by 2030, twice as many as Volkswagen or Toyota. Tesla must therefore grow even faster than the electric car market in the future, says car expert Ferdinand Dudenhöffer from the CAR Institute. In the still young market, Tesla must therefore get market share from the competition. "He has created the conditions for this with his highly profitable New Manufacturing. With this he can set the price lever and push the traditional car manufacturers out of the future market of electric cars with dumping."

Analyst Ferragu also sees good opportunities for 2023 in Tesla's energy storage business. That should also be a topic at the Investor Day. "Tesla has historically faced supply shortages when it comes to energy storage," Ferragu writes. "And with the commissioning of the new Megapack facility in Lathrop, quadrupling the company's production capacity, we expect to see a turning point in 2023-2024." Megapacks are Tesla's utility energy storage products. They help power companies make wind and solar systems more reliable by storing energy so it can be fed into the grid when the sun isn't shining and the wind isn't blowing.

Ferragu expects energy storage to add around $0.20 and $0.55 to Tesla's earnings per share in 2023 and 2024, respectively. A gain of that magnitude would be a pleasant surprise for investors. Wall Street currently projects earnings per share of about $4.10 and $5.60 for 2023 and 2024, respectively. Most of that comes from Tesla's auto business.

Canaccord analyst George Gianarkas thinks the eccentric Elon Musk might have a few other things in store for investors at his investor event as well. He's on the lookout for a share buyback and new commercial vehicles. Tesla also has a commercial product here. His articulated lorry was delivered in December. Cheaper Teslas, new commercial vehicles, new storage deals, and the potential use of capital for share buybacks certainly have plenty to talk about.