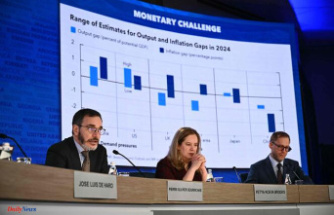

Rising 10-year Treasury yields are dragging down the stock market. At the end of the trading day, the Dow recovers. Shares in the pharmaceutical company Novavax are going down.

In view of persistently high interest rates on the capital markets, investors on the US stock exchanges held back on Wednesday. The Dow Jones Industrial closed 0.02 percent higher at 32,661.84 points. The index fell to its lowest level since November. Above all, the price gains of classic industrial stocks such as Caterpillar, 3M and Dow Inc. saved the Dow from higher losses.

The yield on ten-year US Treasury bonds rose above the four percent mark for the first time in almost four months in the middle of the week. That's twice the average dividend yield of the 500 companies in the S

The share price of the pharmaceutical company Novavax collapsed by more than a quarter after the group announced a surprisingly high quarterly loss. Sales development was also disappointing. In addition, Novavax sees great uncertainty regarding the sales prospects for 2023 and is considering a significant reduction in its expenses.

The shares of the electric car manufacturer Rivian suffered a price slide of more than 18 percent. Weak figures and a disappointing outlook also had a negative impact here. The shares of the big competitor Tesla lost 1.4 percent in the wake of Rivian. In contrast, the solar group First Solar was able to inspire investors with a surprisingly good earnings outlook, as shown by a price increase of almost 16 percent. Disappointing sales by the retailer Kohl's in the fourth quarter of 2022 pushed the price down almost two percent.

Among smaller stocks, Reata Pharma's shares have soared nearly 200 percent. The US Food and Drug Administration has given the green light to the company's drug for a rare disease of the central nervous system. On the foreign exchange market, the euro appreciated against the US dollar in February after high inflation in Germany. Most recently, the euro cost $1.0666. The European Central Bank (ECB) had previously set the reference rate at $1.0684. The dollar had thus cost 0.9360 euros.

US government bonds came under pressure. The futures contract for ten-year bonds (T-Note Future) lost 0.59 percent to 110.52 points. For the first time since January, the yield on ten-year government bonds rose above the 4 percent mark.