Investors on Wall Street did not let go of inflation concerns at the end of the week. The Dow is controlled, among other things, by the pharmaceutical company Merck

The topic of interest rate hikes did not let go of investors on Wall Street on Friday either. However, late in the day, the indices recovered from the daily lows because there were also signs of easing in interest rate speculation. Because import prices fell a bit more than expected. US import prices have been declining since June 2022, providing a certain sign of relaxation.

However, the long holiday weekend in the USA gave many investors reason to hold back their purchases. Trading on Wall Street was suspended on Monday for President Washington's Birthday. The Dow Jones index made the leap into the plus late and rose by 0.4 percent to 33,827 points, p

The day before, prices had fallen sharply after surprisingly significant increases in producer prices and hawkish statements by US central bankers had fueled expectations that the Federal Reserve would raise interest rates more than previously assumed. On the financial markets, the probability of a rate hike of 50 instead of 25 basis points is priced in at 21 percent in March, compared to just 9 percent a week ago. Goldman Sachs economists also raised their interest rate forecasts. They now expect an increase of 25 basis points in March, May and June.

Fed Governor Michelle Bowman fueled interest rate fears. She expressed disappointment at US inflation data for January, saying the Fed needs to raise interest rates further to bring down "way too high" inflation. Meanwhile, Richmond Fed President Tom Barkin backed plans by the US Federal Reserve to continue raising interest rates in quarter-point increments. In his statements, dealers heard more of a dovish tone.

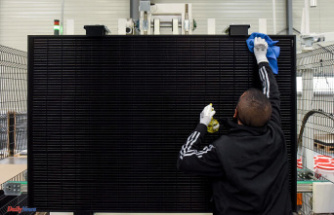

The Dow was supported by Merck, among others

Applied Materials ( 0.04%) presented solid business figures, but the just started 2023 fiscal year was described as "challenging". Moderna fell 3.3 percent. One of the company's flu vaccine candidates was not consistently convincing in a clinical study. The agricultural machinery group Deere had exceeded market expectations with its business figures, the course rose by 7.5 percent.

After the fall in import prices and the Barkin statements, which were interpreted as dovish, yields turned negative and prices on the bond market rose. Apparently, there was no unanimous opinion among investors on the financial markets about the future interest rate path. As market interest rates fell, the dollar gave up the premiums that had pushed it to its highest levels since early January; the dollar index increased only very thinly on a daily basis.

On the oil market, prices posted their highest daily loss since February 3rd. Expectations of interest rates rising further fueled fears that the US economy could slip into recession. Demand for oil also suffered as a result, according to the trade.