If the pensionsbolaget have a life expectancy assumption, in 20 years, so it means that you have to believe that the customer is going to live in business for 20 years, after the age of 65 years.

Pensionspåsen, the saving of the tjänstepensionsförsäkringen, which is due to be paid shall be divided at the age of 20. If pensionsbolaget has been an adoption of the 25-year-old, the pensionspåsen split up at the age of 25 years.

this, Then, is getting the payments each and every month, lower than they are supposed to last longer. A lower life expectancy assumption simply provides a greater pension payments each and every month.

It should be stressed that the accrued pension amount is the same, that is, the distribution of it and how it is portioned out, which will be determined by, among other things, livslängdsantagandet.

in the Case of a lifetime-payoutIf you take a closer look at all of the providers, you can see that in the assumptions concerning longevity are very different between the two companies. One of the companies assuming, for example, their female insurance customers will have to live for more than 25 years after they have retired, at the age of 65. That is to say, that on average they will be 90,2-year-old.

"Interesting," since the average life span for women is 84 years, according to statistics SWEDEN the year 2018. When I retire, it won't hurt to ask pensionsbolaget why do you think that their customers will live a lot longer than the average, " points out sparekonomen Leigh Bratt.

If the person dies before all the money is paid out from the insurance company, and has decided that the money should be allocated to the survivor, then to the other depositors of the pensionsbolaget, and is distributed as a arvsvinster.

this is true for the individual, occupational pensions and so-called lifetime payment, that is to say, that the pension should be paid throughout the life of the man, after all, can opt for payment in five, ten, or fifteen years, if you'd like).

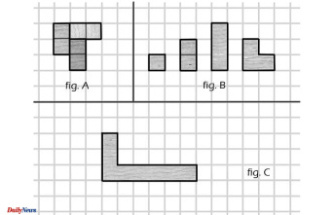

for EXAMPLE: how do the 900 crowns

In dollars and cents, it can make quite a big difference in pensionsbolaget to believe that you and our other customers in the event of the death.

We look at, say, of Susan. She has a means of occupational pension insurance with a million dollars in it. She chooses to be, it is to be paid out of the life, that is to say, each and every month from the time that she retire at the age of 65 until her death.

On the livslängdsantagandet of her providers, is a 20-year means of monthly pension payments of 4 of the 200 dollars.

On the livslängdsantagandet 25 years of age and reduce the payout for the 3 for 300 dollars.

), A difference of 900 sek per month.

Note: In the above example, we have not assumed any such changes in the utbetalningstiden. However, in reality the growing of the money, hopefully, in value terms, even in the utbetalningstiden, and sometimes they expect the companies with a prognosränta, which will also determine how the payments are to be distributed.

to View merVisa off < / span>

Under the collective bargaining agreements is determined on the mortality assumptions in each of the respective agreements.

note also that some of the companies in the group have a different life expectancy assumptions for males and females, due to the fact that women live longer, on average. At the same time, it means that the women in some of these cases, the lower the pension payments for each month of retirement, said Leigh Bratt, and adds the following:

" at a time when many of the poorest pensioners are women. Under the collective bargaining agreements use the same mortality assumptions for men and women, but not here in the individual outside of the collective bargaining agreements.

Pensionsekonomen Kristina's Struggle at the time of My retirement, which is Taken pensionsexpert, according to the companies, among other things, making assumptions on the basis of profession and age.

" the Servants are expected to live longer than blue-collar workers. How old you are may also play a role. You are young, you can have a life expectancy assumption than that if you are close to retirement age. The younger is expected, of course, to live longer than older people.

”watch out for the higher fees,”Christina Kamps tip is to take a look at the livslängsantagandena (see listing below), before making the decision on how you want to take it out of their occupational pension scheme.

" Now, there's not so many people who have occupational pensions outside of collective bargaining agreements, however, if you have it, so it might be better to take the pension in a shorter period of time. Those who might benefit from its occupational pension scheme of an insurance policy with a different life expectancy assumptions, for the women's and men's – men's. However, make sure that is not the livslängdsskillnaden be eaten up by higher fees and worse terms and conditions.

if you don't utbetalningsplanen is correct, you can change the tidspannet, then they would take the money out. However, it has to be done before the payments start rolling in.

– if you Are not happy then you can think about whether it's better to take out a pension in a shorter period of time in the context of this policy. That livslängdsantagandet't matter that much. However, keep in mind that you are going to have plenty of money left over in the second pension, so that you can handle on your finances if you are getting very, very old, " explains Christina's Struggle. And, she adds:

" of course, You can choose to move the money, but it is the right of a costly affair, and so, the question is whether it is worth it.

So far assume the pension companies life

This is the life expectancy assumptions in the individual's occupational pension. Where only one figure is given, it means that the company will have the same life expectancy assumption for both men and women. < / span> < / span>

the Woman, at 24.4 years old.

a Man, 22 years of age.

the Woman, at 24.4 years old.

a Man, 22 years of age.

and 22,6 years old.

for 20 years < / span>

the Woman: Of 24.5 years.

To: 21,8 years old.

it was 23.3 years old.

at 22.5 years old.

Female: 22.3 years.

the Man is 21.4 years old.

Female: 22.3 years.

the Man, 21.4 million in the year.

None.

at 22.5 years old.

and of 19.2 years.

the Woman 24.8 million in the year.

Man: 22.3 years.

a Woman is a 24.5 years old,

the Man, Was 22.2 years old.

Woman: 25,2 years.

Man: is 21,7 years.

and of 21.9 years.

a Woman is 22,8 years.

the Man was 21.3 years old.

Woman: 25,2 years.

the Man, 21 years of age.

Woman: 25,2 years.

a Man and 21 years old.

Source: the Consumer.see the.

to View merVisa off. READ MORE: , So the shrinking of the revenue at the rapid withdrawal of benefits. READ MORE: 13 tips for you, in the midst of life – saving for you retirement. READ MORE: So much the increase of the pension, but efterlevandeskyddet READ MORE: , the Selection of which affects your income for the rest of the livetTV: Why is the occupational pension for key Date Of Update: 03 March 2020, 14:00