The white label war is intensifying. Supermarkets intensify their strategy with the launch of new products from their own distribution chain to offer a basic shopping basket at more attractive prices and thus gain market share in an environment of fierce competition due to inflation.

In this complex context, some of the large supermarkets that operate in the country are placing basic white-label foods on their shelves that, until now, were not available, which is leading to considerable price drops on certain products with reduced VAT.

This has been detected by the Association of Financial Users (Asufin), which since the beginning of the year has been monitoring the evolution of the prices of the subsidized shopping basket in the five major distributors in the market: Mercadona, ECI (Grupo El Corte English), Carrefour, Alcampo and Dia.

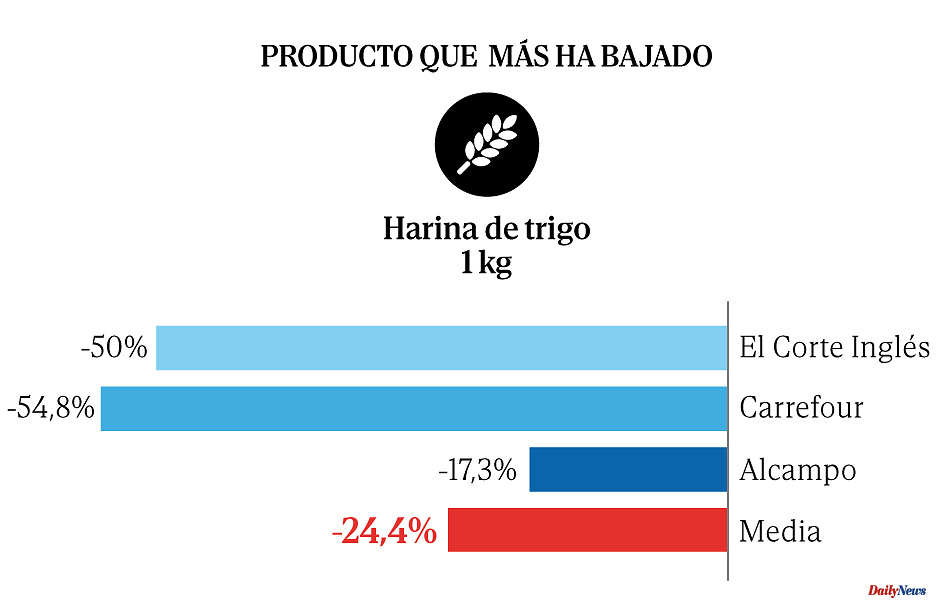

The most striking case is that of ECI, which this May began to offer its customers private label flour and pasta. Consequently, the price of flour in its supermarkets has plummeted by 50%, noodles have become cheaper by 34% and macaroni by 46%.

Carrefour, for its part, has also launched private label flour this month, causing a 55% price drop. And the same strategy has been followed by Alcampo, where the price of flour has decreased by 17% compared to April, after incorporating the own brand product.

Due to these launches of white-brand flours in these three chains, in the overall calculation of the five supermarkets the price of this food has been reduced by 24.4% this May compared to April, since in Mercadona and Dia has remained stable.

On the other hand, it can be seen how the withdrawal of private label rice by Carrefour has caused a 38% increase in the price of this product in its establishments, while in the rest of the supermarkets the evolution has been null. In this way, the impact on prices of business decisions to launch or withdraw products from the distributor is clearly verified.

"White brands and promotions are distorting the Government's VAT reduction," they say from Asufin. All in all, from the monitoring of prices since the beginning of the year, it can be deduced that the basic shopping basket has become 3.5% more expensive despite the fact that VAT has fallen from 4% to 0% on bread, flour, milk, eggs, fruit or legumes and from 10% to 5% in oils and pastes.

Specifically, the average basket cost 29.61 euros on January 30 (Asufin takes this date as a reference to clear the return effect of Christmas) and the same purchase, on May 25, costs a total of 30.66 euro. "The reductions are only taking place in specific products due to promotional strategies and private label, because supermarkets are offering wider ranges of products, not because of the VAT reduction", Asufin insists.

The distribution sector already takes for granted that the Government will withdraw the bonuses to the shopping basket as soon as the measure reaches its expiration date, next June 30. And that's when they expect a strong rebound effect. "Despite the fact that costs are being contained at the beginning of the chain, the pressures persist and as soon as VAT returns to its normal level, prices will rebound," they predict.

The economic vice president, Nadia Calviño, has already slipped that the VAT reduction will not be extended beyond June because Brussels is asking that the aid be withdrawn now. The decision will depend, in any case, on how inflation evolves in the coming weeks.

According to the criteria of The Trust Project