Discussions around the finance bill (PLF) for 2024 and the programming law until 2027 have brought the question of public debt and its cost back into the spotlight. The first president of the Court of Auditors, Pierre Moscovici, was concerned, describing the increase in the debt burden, that is to say public expenditure devoted to the payment of interest, as “spectacular”. Presenting the budget, the Minister of the Economy, Bruno Le Maire also insisted on the increase in the rates at which France now borrows.

In fact, between 2021 and 2023, rates rose from almost zero to more than 3% for a ten-year loan. According to Bercy's forecasts, the debt burden would become the country's largest expenditure item in 2027, ahead of education and the army. How did we get here and should we be concerned?

The State goes into debt on a recurring basis to finance public operating and investment expenditure. He borrows, pays interest (“coupons”), repays at maturity and takes out new loans.

Before the 1970s, France resorted to national borrowing from citizen savers; from now on, it mainly borrows on the financial markets. It is the France Trésor Agency (AFT), located in the heart of Bercy, which is responsible for managing these operations. AFT warns investors that it will need financing. Each player says how much they are prepared to put in and, based on the offers, the AFT allocates prizes at the most attractive rates for them.

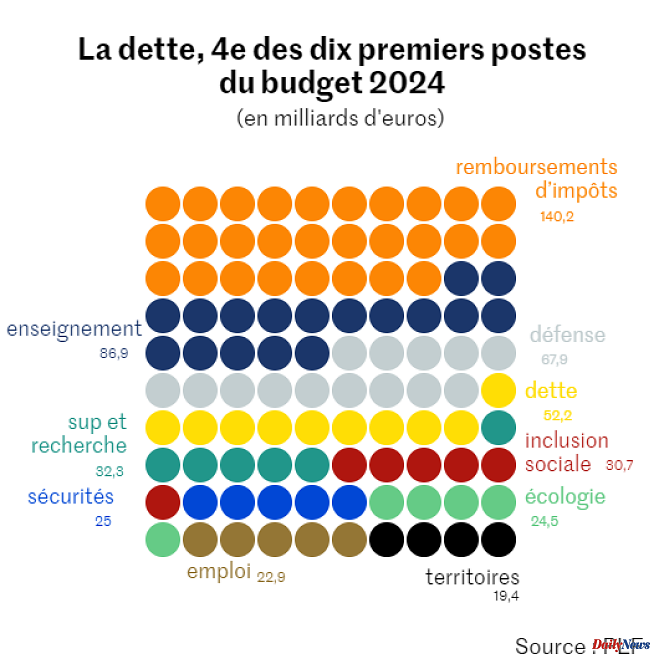

The line allocated to the debt burden – also called “debt service” – and to the State treasury would represent 52.2 billion euros next year. According to budget documents, this will be the fourth largest public expenditure item. Far behind tax refunds to businesses and individuals (under tax loopholes or incentive schemes) but also behind the budgets allocated to national education and defense.

There are three reasons for the increase in the debt burden: one, which mainly concerns the year 2022, is linked to inflation. Because the State borrows a small part of its debt – around 10% – at variable rates. However, the latter are linked to inflation (French and European). When consumer prices soared, these variable loans followed, the bill rising at the end of 2022 to 23 billion euros, or almost half of the interest paid that year.

The second reason is the rebound in all interest rates in the euro zone, for businesses, individuals, but also for States: they follow the movement initiated by the European Central Bank which raised its key rates to a level never reached. While these rates have long been close to zero, the rise to around 3% (in the case of fixed rate loans from the French State over ten years) is necessarily painful.

The last reason is the increase in volume of borrowing amounts planned for next year: 285 billion euros, compared to 270 billion euros this year, a record level.

The government justifies its desire to reduce public deficits by this rebound in rates which would burden the state budget. In this light, getting the country out of debt would be “a categorical imperative”, according to Bruno Le Maire.

But the effects of rising rates on France's fixed rate loans are progressive: the French state has loans with various maturities, which range from three months to thirty years. Next year, less than 10% of the 3,000 billion euros in stock of French loans will be renewed. When they mature and it is necessary to subscribe to new ones, the State knows that it can obtain attractive rates because lending money to the State remains a safe investment, which is not so current on the financial planet. With each issue, AFT places its debt without problem and has even been able to benefit from negative rates in recent years, with investors paying to lend to France.

On the other hand, as the majority of economists anticipate, the inflation which boosted variable rates should begin to decline in the years to come, and the increase in prices which penalized the year 2022 should gradually dissipate. Moreover, borrowing is a good economic calculation in times of inflation because the rise in prices reduces the real value of savings, assets but also... debts.

Finally, France's situation is not unique: in Western countries, public debt has continued to grow with the decline in growth and the liberalization of financial markets, offering States continued financing possibilities. more generous. In absolute value, the American debt has increased sixfold in twenty years, as has that of the United Kingdom.