Continued growth in France has reduced the weight of public debt and deficit in 2022, but public finances remain degraded, with debt approaching the symbolic threshold of 3,000 billion euros in absolute value.

A decline in spending and an increase in tax revenues have brought some balm to the heart of public accounts heavily affected by the health crisis and then the surge in energy prices exacerbated by the war in Ukraine.

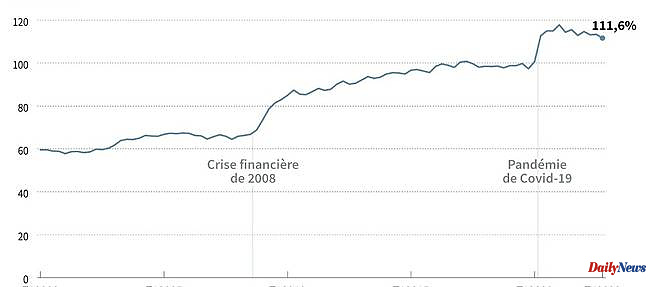

Public debt fell to 111.6% of gross domestic product (GDP), against 112.9% in 2021, in line with government expectations, the National Institute of Statistics (Insee) said on Tuesday.

The public deficit did better than expected, falling from 6.5% to 4.7% of GDP, falling below the official target of 5%.

The Minister of the Economy, Bruno Le Maire, on Tuesday hailed the "resilience" of the economy which led to this improvement, while reaffirming his "total determination (...)" to restore public finances, in a climate electrified by the opposition to his pension reform.

Because the debt and the deficit remain much higher than their pre-crisis level in 2019, due to the “whatever the cost” deployed by the government to support households and businesses, and which it now intends to reduce. Public debt then represented 97.4% of GDP when the public deficit stood at 3.1%.

In absolute value, France's indebtedness widened by 126.4 billion euros in 2022 over one year, reaching 2,950 billion euros, approaching the symbolic cap of 3,000 billion euros.

The public deficit stood at 124.9 billion euros, benefiting from rising revenues (53.4% of GDP against 52.6% in 2021) while expenditure fell to 58.1% of GDP (compared to 59.1%).

Revenues increased by 7.3% (i.e. 95.7 billion euros) thanks to the continued post-Covid catch-up of the French economy (2.6% in 2022), as well as inflation which notably inflated VAT receipts. “The good news is that there has been a dynamic in the French economy which has made it possible to have expenditure which does not increase as quickly as revenue”, comments Charlotte de Montpellier, economist at ING.

"It's a little better than we might have feared, but the public finance figures are still unfavorable" and place France among "the worst European countries", she added to AFP .

To restore public finances, the government is counting mainly on a faster rise in GDP than that of expenditure, which would be the subject of "several billion euros in savings".

It anticipates growth at 1% in 2023, a forecast higher than those of international institutions.

"The difficulty for the future is that the strong dynamism of tax revenues will not necessarily last," warns Mathieu Plane, deputy director of the analysis and forecasts department of the OFCE. "In 2023, we are on a much more subdued growth trajectory," he added to AFP.

The government is due to present its multi-year trajectory for public finances around mid-April. At this stage, it is counting on a public deficit of 5% in 2023 which would gradually be brought below the European limit of 3% in 2027, while the debt would stabilize at 110.9% by this horizon.

At the beginning of March, the Court of Auditors was alarmed by the lack of ambition, according to it, of these objectives.

This surge in debt since the health crisis weighs on public finances by considerably increasing the debt burden. This has also increased with the rise in interest rates, while part of the outstanding amount is indexed to inflation.

The burden of public borrowing has thus increased by 15.1 billion euros in one year, to 53.2 billion in 2022, according to INSEE.

At this stage, investors are not worried. The French debt is considered a safe asset and the difference ("spread") with the interest rates of Germany, which is the benchmark in the EU (European Union), has not significantly widened.

But the pressure will also increase at European level: suspended during the Covid, the Stability Pact limiting the budget deficit to 3% of GDP and the public debt to 60% will soon be reactivated.

03/28/2023 10:11:23 - Paris (AFP) - © 2023 AFP