The rapidly rising interest rates mean that owners of a property who sell them often have to pay a lower prepayment penalty or no prepayment penalty at all. However, many banks do not pass on this advantage correctly.

Anyone who repays construction financing before the end of the fixed interest period, for example because the property is being sold, owes the bank compensation if they can only reinvest the money repaid at a lower interest rate.

This so-called prepayment penalty essentially depends on two factors: Firstly, the interest rate at which the customer took out his real estate loan. And second, the market interest rate at the time of early repayment. This market interest rate has risen rapidly in recent months - not least due to the multiple interest rate hikes by the European Central Bank (ECB).

As a result, many banks are not allowed to charge any or only a low prepayment penalty. In our experience, however, a number of credit institutions do not comply. In practice, customers usually ask their bank about the amount of the prepayment penalty several weeks or even months before the actual sale. This calculates the value based on the then valid market interest rate. At the time of the actual repayment of the loan, this value would actually have to be updated again and thus adjusted to the current rise in market interest rates.

This would mean a significant reduction in the fee or even its complete elimination. But many banks "forget" this adjustment. An example from our practice shows how big it can be: A bank charged a prepayment penalty of EUR 23,500. Correctly calculated, on the other hand, 9000 euros would have been due. Only after our intervention did the bank lower its claim. Not an isolated case: In the current market environment, many customers pay far too high early repayment penalties. It is not uncommon for this to amount to several thousand euros.

Private borrowers can also get this money back later. In some cases it is even the case that the bank is not entitled to any prepayment penalty at all because it does not correctly inform the customer about the calculation in the loan agreement. Commerzbank is particularly affected here, where the Federal Court of Justice (Az.: XI ZR 320/20) has already ruled. Anyone who has paid a prepayment penalty in the past few years should have it checked to see whether one of these two points applies to them.

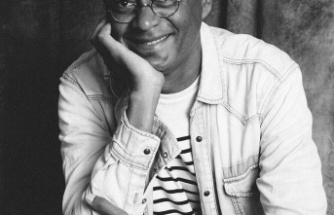

About the author: Roland Klaus is the founder of the revocation interest group, which deals with consumer protection issues. He became known as a Frankfurt stock exchange reporter for n-tv, N24 and the US financial broadcaster CNBC.